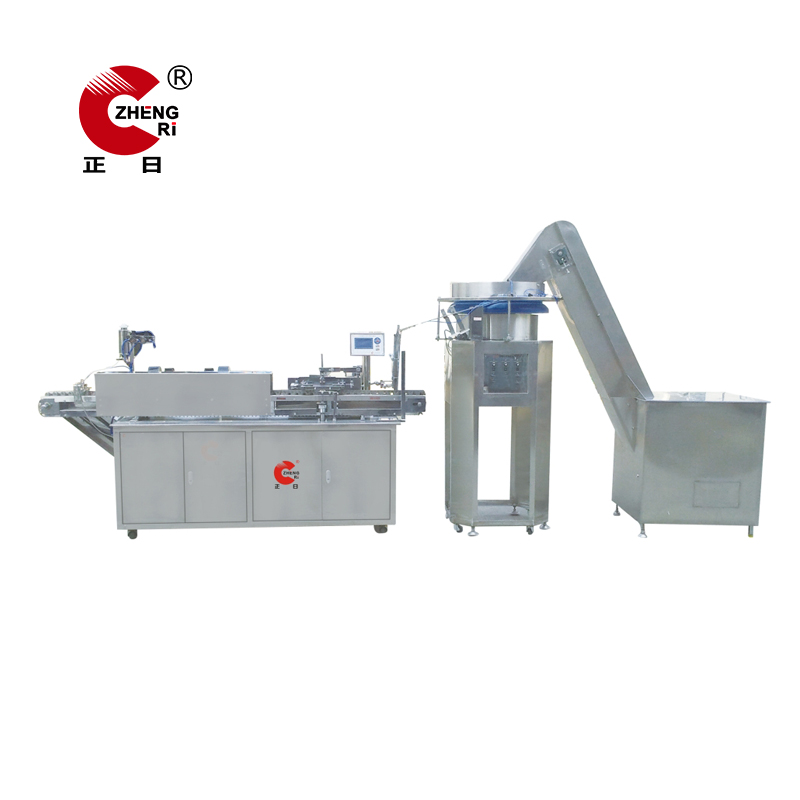

Printing Machine is a kind of machine to print text and image, and it generally consists of plate loading, ink application, embossing, and paper feeding (including folding).

It works by first making a plate of the text and image to be printed, mounting it on a printing press, and then applying the ink to the place where the text and image are printed on the plate by hand or by a printer, and then directly or indirectly printed on paper or other substrates (such as textiles, metal sheets, plastics, leather, wood, glass, and ceramics) to replicate the same print as the plate.

There are many types of printing machine. Classified by plate form, it mainly includes letterpress printing machine, gravure printing machine, offset printing machine, Silk Screen Printing Machine, flexo printing machine, digital printer, Pad Printing Machine.

Any interest, please don`t hesitate to contact us. We will be on service for you at any time.

For inquiry, please send mail to us at any time.

Printing Machine Silk Screen Printing Equipment,Syringe Screen Printing Equipment,Automatic Screen Printing Machine ,Syringe Printing Machine Yuhuan Zhengri Technology Co., Ltd. , http://www.syringemachine.com

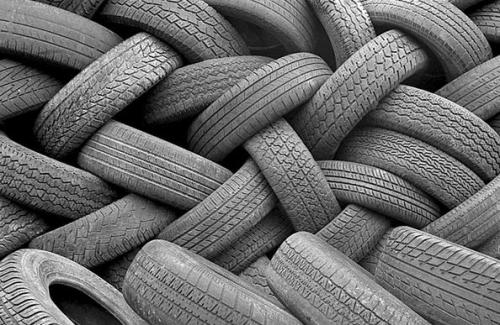

The development of China's tires in 2014

After China's tire industry experienced a series of twists and turns, such as the decline in sales volume and the drop in raw material costs, the current development is relatively stable. However, the level of development of domestic tire companies is uneven, and the industrial structure of the industry is in urgent need of adjustment. As an essential tool for driving vehicles, tires have a huge market space in China.

Champ Consulting industry analysts pointed out that to achieve healthy and effective growth, the tire industry needs to control production capacity and achieve transformation and upgrading of the industry. In response to the current state's demand for environmental protection, the tire industry is required to adjust to the development of green environmental protection. The development of green tires is the trend of the times, and it is also a must-go road to achieve industrial industrial structure optimization.

At present, there are many small and medium-sized enterprises in the tire industry in China, and the industry cluster is not enough. Many small and medium-sized enterprises are small in scale and disperse in their layout. Market demand determines that their R&D driving is not sufficient. The diversification of industrial capital will accelerate their ability to subdivide and lay out markets, making them unable to carry out market challenges. Competition also leads to the limitation of the development of the entire industry. Therefore, the urgency of product structure adjustment is increasing. Eliminating outdated production capacity and digesting some of the production capacity will cause some bankruptcy tire companies to go bankrupt and change production, which will greatly reduce the burden on the industry and achieve industrial clustering.

The road to green development is a must-go road to realize industrial restructuring of the tire industry. Taking the road of green development can maximize the utilization of resources, eliminate pollution in manufacturing processes, and limit the control of dangerous goods. To successfully realize the green transformation of the tire industry, we should create a good atmosphere for accelerating the development of green, low-carbon, and circular science in the whole society. For the tire industry, the government should play a leading role in demonstration, and priority should be given to environmental protection and fuel saving in official procurement. The green tires guide the concept of green consumption, and at the same time establish a force-resolving mechanism for the green tire legislation, and raise the green tire self-discipline to national laws and regulations.

In the “2014-2017 China Tire Industry Market Survey and Investment Prospects Analysis Reportâ€, Shangpu Consulting stated that the pressure for tire industry transformation has been increasing. On the one hand, we must give full play to the leading role of the government and guide the transformation and upgrading of enterprises through policies. On the other hand, the market should also be given full play of its activity so that all its various factors can be positively manifested, so that competitiveness can be increasingly developed towards science and technology, and it can be developed into a circular economy.

Different from previous years, the domestic rubber market demand this year is particularly "cold." The sharp decline in raw material preparation willingness of tire companies before the year not only caused the seasonal demand season to disappear, but also led directly to rubber traders suffering from "cold catastrophes." I hope that after the Spring Festival, we can usher in the stock market for rubber raw materials for tire manufacturers, but whoever wants to think that good expectations will once again fail, and the “downswing†as a downturn will make rubber traders only hope that they will be completely extinguished. .

Financing plastics business is limited by the increasingly difficult survival of traders in the face of deteriorating living conditions, but also in the relatively weak link of the industry chain. As early as in previous years, most domestic rubber traders will “dispose of homes†and open up “moneyâ€. King" has given up trading principal business and turned to financing sideline, this phenomenon is particularly prominent in Shandong. However, as the country continues to strengthen the rational allocation and management of liquidity resources, and this year's central bank’s “money bag†policy has maintained a tight posture, rubber traders who have been relying on “financing plastics†business and “breading up for a living†will suddenly feel The hardships of living conditions.

The so-called "financing glue" is similar to financing copper. This method can bring the company a few months of cheap funds, and take this money to switch to high-interest markets, you can get the spread income. As the financing plastics business has a higher profit than normal business, it has led other traders who are doing business in a proper manner to follow suit, and at one time financing has become a common phenomenon in the industry. It is estimated that only about 240,000 tons of stocks have been deposited as a result of financing the rubber business in Shandong.

High-yield interbank borrowing leads to high demand for financing. “The terminal demand is not optimistic and banks are not giving renewal funds to make our financing business more and more difficult to do. The sales of goods that are held in hand will not go out and corporate liquidity will be depleted. Even The hardships are not going to survive anymore.†This is the most common sentence I heard during the conversation with many Shandong rubber traders. Indeed, according to a report issued by the China Automobile Dealers Association, China's auto dealership stocks early warning index was 50.5% in January this year, an increase of 10.5 percentage points month-on-month. In February, China's auto dealership stocks early warning index continued its upward trend and rose again. 7.7 percentage points, to 58.2%. Among its sub-indicators, the stock index was 64.8%, an increase of 19.1 percentage points from the previous quarter; the market total demand index was 13.8%, a 32.2% decrease from the previous quarter; the sales index was 20%, a decrease of 24.2% from the previous quarter. Although there were vacation factors in February, compared with previous years, the degree of contraction in terminal demand was far more than market expectations.

In the case of unsatisfactory end-user car consumption, the operating rate of post-holiday tire companies failed to rebound quickly. It is understood that the current operating rate of large-scale tire factories in Shandong is 40-50%, while the operating rate of small-scale tire factories is about 80%, which is less than the same period of previous years. In addition, rubber prices have been declining steadily to aggravate the cautious attitude of merchants for raw material purchases. The decline in the willingness of tire companies to make up the inventory directly led to sharp reductions in the destocking power of rubber traders and Qingdao Bonded Area. According to statistics, as of mid-February, the bonded stock of rubber in the bonded zone was 340,000 tons. If you count implicit stocks, your total stock may exceed 480,000 tons.

Given this situation, the bank’s confidence in continuing to lend to traders has declined, and some have even urged it to repay the loan as soon as possible. The majority of traders are using low-interest funds from banks to invest in high-interest markets. It is difficult to return funds in a short period of time. In the general environment of tight liquidity, high-yield market default events have occurred (borrowing unrecoverable and bad debts ). In the dilemma of not being able to sell inventory and selling loan funds, the traders can only resort to the help of "bridge capital" to cope with bank pressure. The so-called "bridge capital" refers to private short-term borrowing funds and interest is high. It is understood that the capital price of bridges in Shandong has now risen from three-and-a-half years ago to six-tenths of a thousand, which has doubled and translated into an annualized interest rate of 216%. Although the law of drinking and quenching thirst can save a moment, Urgency, but it is no different from the chronic suicide, but also can not improve the status of rubber high inventory.

In the face of high interest-rate funding pressures and depressed demand outlook, some trader companies are already on the verge of bankruptcy, and more and more rubber stocks used to finance plastics businesses have gradually turned into “dead stocks,†which cannot move, triggering rubber stocks. The "high fever" inflammation is still difficult to subside for a time.

According to Gasgoo, the Freedonia Group, a US market research organization, recently released a research report predicting that tire sales worldwide will increase by 4.3% annually in the next few years.

According to the forecast of the Friedonia Group, the annual global sales of tires will increase to 2.9 billion by 2017. From the perspective of the value of tire sales, global tire sales are expected to reach US$276 billion by 2017, and the annual growth rate is expected to be 8%.

The Asia-Pacific region will become the main driving force for the growth of the tire market. The sales volume of tires in the Chinese market in 2012 accounted for 22% of the global market, and it is still growing. In addition, the Indian tire market will also maintain strong growth in the next five years, and is expected to surpass Japan, becoming the third largest tire market in the world.

As for the Japanese market, the country’s tire sales are expected to decline during 2017, affected by shrinking population and declining auto exports. The demand for tires in developed international markets such as Western Europe and North America is expected to maintain growth, but the average annual growth rate is expected to not exceed 2%.

The Friedonia Group expects that the United States will continue to maintain the world’s second-largest tire consumer market, and its tire sales volume is expected to reach 13% of the global total by 2017.